Carnival (CCL) Stock Reverses Sharply After Spiking to New 52-Week High

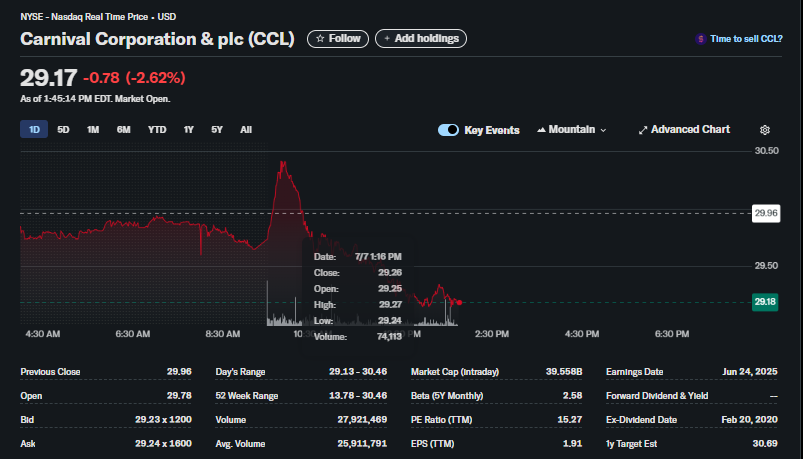

Carnival Corporation (CCL) is experiencing a tumultuous trading day, defined by a powerful but short-lived rally. As of 1:45 PM EDT, the cruise line’s stock was trading at 0.78 (-2.62%).

The intraday chart tells a tale of two very different market moves. At the 9:30 AM market open, the stock exploded upwards on a massive volume spike, surging from its opening price to a new 52-week high of 29.13, having erased all its morning gains and more.

Should You Buy or Sell CCL Stock Today?

The stock’s violent reversal from a major high presents a clear warning sign for traders.

-

For the Bulls (Potential to Buy): Optimistic traders might attempt to “buy the dip” near the day’s low of $29.13, viewing it as a potential support level. However, given the strong rejection at the highs, this is a high-risk strategy that bets on a significant sentiment reversal.

-

For the Bears (Potential to Sell): The bearish case is very strong. A “spike and reverse” pattern from a new 52-week high on high volume is a classic bearish signal. It suggests that many investors used the new high as an opportunity to take profits, and sellers are now in firm control. Bears may see any small bounce as an opportunity to short the stock.

Conclusion: Extreme caution is warranted. The powerful rejection from the 52-week high is a significant bearish event. Sellers appear to have the upper hand, and the path of least resistance currently appears to be to the downside.

Analyst Opinion

Today’s price action in Carnival (CCL) stock is a textbook example of profit-taking at a major resistance level. The stock rallied to a new 52-week high of $30.46, which is very close to the 1-year analyst target estimate of $30.69. It’s common for stocks to face heavy selling pressure at such levels. While the company is profitable (P/E of 15.27), its high Beta of 2.58 means it is prone to these kinds of volatile swings. The failure to sustain the breakout attempt is a significant technical event that suggests the stock may need to consolidate or pull back further before attempting another move higher.

Frequently Asked Questions (FAQ)

1. What happened to Carnival (CCL) stock today?

CCL stock surged to a new 52-week high of $30.46 right after the market opened but was immediately met with intense selling pressure, causing it to reverse and fall sharply for the rest of the session.

2. Why did CCL stock fall after hitting a new high?

This is likely due to significant profit-taking. When a stock reaches a new 52-week high that also aligns with analyst price targets, many investors choose to sell their shares and lock in gains, creating heavy selling pressure.

3. Is Carnival a volatile stock?

Yes. The provided data shows a Beta of 2.58, which indicates the stock is more than twice as volatile as the overall market. Today’s wide trading range confirms this.

4. What are the key price levels for CCL today?

The key support level is the day’s low at $29.13. The major resistance was the day’s high and new 52-week high at $30.46.

5. Is Carnival Corporation profitable?

Yes, according to the data, the company has a positive trailing twelve-month (TTM) EPS of $1.91 and a P/E ratio of 15.27.

6. What is the analyst price target for CCL stock?

The 1-year target estimate shown in the image is $30.69, a level the stock nearly reached at its high today.