Alphabet (GOOGL) Stock Holds Steady in Tight Trading Range, Analysts See Significant Upside

NEW YORK – Shares of tech conglomerate Alphabet Inc. (GOOGL) are trading nearly flat in today’s session, showing remarkable stability despite some early intraday volatility. The stock’s performance on the Nasdaq suggests a period of consolidation as investors weigh the company’s powerful market position against broader economic signals.

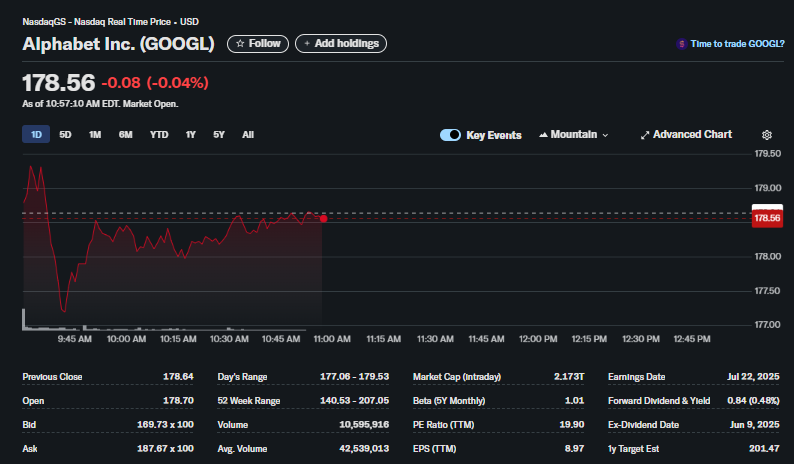

As of 10:57 AM EDT, Alphabet’s stock price was 0.08, or -0.04%, from the previous close. The stock has been trading in a tight band, hovering just below its prior closing price of $178.64.

Intraday Trading and Market Fundamentals

The session for GOOGL began with an open at $178.70, followed by a brief dip to a day’s low of $177.06 before recovering. This price action indicates a balanced struggle between buyers and sellers. The day’s trading volume was just over 10.5 million shares, which is moderate compared to its average volume, suggesting a lack of a strong directional catalyst in the early hours.

Despite the muted daily performance, Alphabet’s fundamentals remain a beacon of strength. The company commands an immense market capitalization of $2.173 trillion. Its profitability is robust, with a trailing-twelve-month (TTM) EPS of 8.97 and a reasonable P/E ratio of 19.90, making it an attractive investment from a valuation standpoint compared to some of its mega-cap tech peers.

Future Outlook and Investor Appeal

Looking ahead, Wall Street remains highly optimistic about Alphabet’s prospects. The 1-year analyst target estimate is $201.47, which implies a potential upside of over 12% from the current price. This confidence is likely fueled by Alphabet’s dominance in search and advertising, its growing cloud division, and its leadership in artificial intelligence.

Furthermore, Alphabet has broadened its appeal to a new class of investors by recently initiating a dividend. The stock carries a forward dividend and yield of 0.84 (0.48%), providing a source of income in addition to potential capital appreciation. The stock’s Beta of 1.01 indicates that it moves almost perfectly in line with the overall market, making it a stable, core holding for many portfolios.

In conclusion, while Alphabet’s (GOOGL) stock is experiencing a quiet trading day, its strong financial health and positive future outlook continue to make it a cornerstone of the technology sector and a favorite among investors.

Frequently Asked Questions (FAQ) about Alphabet (GOOGL) Stock

Here is a list of frequently asked questions based on the information provided in the stock market data image.

1. What is the stock ticker for Alphabet’s Class A shares?

The company’s Class A common stock trades on the Nasdaq under the ticker symbol GOOGL.

2. What was the stock price of GOOGL in the image?

The stock was priced at $178.56 at the time of the snapshot.

3. What was the price movement for the day?

The stock was down slightly by $0.08, or -0.04%, indicating it was trading very close to its previous closing price.

4. What is Alphabet’s market capitalization?

The intraday market cap is listed as a massive $2.173 trillion.

5. Does Alphabet (GOOGL) pay a dividend?

Yes. The data shows a Forward Dividend & Yield of 0.84 (0.48%). This is a relatively new development for the company, making it attractive to income-focused investors.

6. What is the 1-year analyst price target for GOOGL?

The 1-year target estimate from analysts is $201.47, suggesting that Wall Street expects the stock price to increase in the coming year.

7. What is Alphabet’s P/E Ratio?

The trailing-twelve-month (TTM) Price-to-Earnings (P/E) ratio is 19.90. This means investors are paying about $20 for every $1 of the company’s annual profit.

8. What does GOOGL’s Beta of 1.01 mean?

A Beta of 1.01 indicates that the stock’s volatility is almost identical to the overall market. It is not considered significantly more or less risky than the market average.

9. What is the 52-week trading range for Alphabet stock?

The stock has traded between a low of 207.05 over the past year.

10. What is the EPS (TTM) for Alphabet?

The Earnings Per Share for the trailing twelve months is $8.97, which indicates strong company profitability.

11. The Ex-Dividend and Earnings dates in the image are for 2025. Is this accurate?

It is highly unlikely. The dates shown (Ex-Dividend Date: Jun 9, 2025, and Earnings Date: Jul 22, 2025) are most likely data errors in the financial platform. Public companies report earnings quarterly, so the next report would be expected in July 2024, and dividend dates are also set on a quarterly basis. Always verify such dates with official company press releases or reliable financial news outlets.